Overview of Fake IDs and Electronic Payments in the United StatesIn the United States, fake IDs and electronic paymentsare two prevalent phenomena that impact various aspects of society. Fake IDs, or counterfeit identification documents, are widely used by individuals seeking to circumvent legal age restrictions, such as purchasing alcohol or tobacco, or engaging in other activities restricted by age laws. These fraudulent documents are often produced with sophisticated techniques and can pose significant challenges for law enforcement and businesses attempting to verify identities.

On the other hand, electronic payments have revolutionized the way transactions are conducted. The adoption of digital wallets, mobile payment apps, and online banking has made financial transactions more convenient and efficient. Electronic payments offer numerous advantages, including speed, security, and accessibility.

Research Question

The integration of fake IDs and electronic payments creates a complex interplay that affects society, economy, and security. The research question about a California scannable ID is: “How do fake IDs and electronic payments complement each other in modern society, and what are their implications for social behavior, economic transactions, and security measures?”

By exploring this question, we aim to understand:

– How the use of fake IDs impacts electronic payment systems and vice versa.

– The extent to which fake IDs facilitate fraudulent activities in electronic payments.

– The broader implications of these interactions on societal norms, economic practices, and security protocols.

This exploration will provide insights into the challenges faced by businesses and regulators, and suggest potential measures to mitigate the associated risks.

Fake IDs: Definition and Uses

Definition and Common Uses

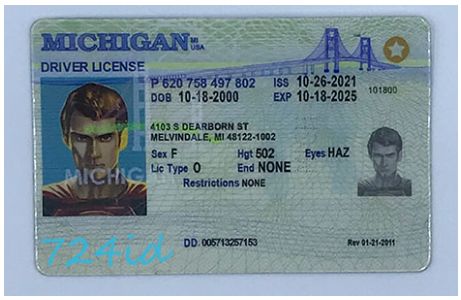

fake ID with Michigan scannable ID refers to a counterfeit or altered identification document used to misrepresent one’s identity. Commonly, fake IDs are utilized to bypass Google Wallet, or other mobile payment solutions.

– Online Payments: Transactions conducted over the internet using credit/debit cards, bank transfers, or online payment services like PayPal.

Advantages of Electronic Payments

– Convenience: Electronic payments offer ease of use and speed compared to traditional methods. Transactions can be completed quickly from virtually anywhere.

– Security: Advanced encryption and authentication technologies enhance the security of electronic payments, reducing the risk of physical theft.

– Impact on Traditional Payments: The rise of electronic payments has transformed traditional payment methods, reducing the reliance on cash and checks, and increasing the efficiency of financial transactions.

Security Risks

Despite their advantages, electronic payment systems face several security challenges:

– Account Theft: Cybercriminals may steal account credentials through phishing, hacking, or other means, gaining unauthorized access to financial resources.

– Information Leakage: Personal and financial information stored in electronic payment systems can be vulnerable to breaches and misuse.

– Fraudulent Use of Fake IDs: Fake IDs can be used to exploit vulnerabilities in electronic payment systems, such as creating fake accounts or conducting fraudulent transactions.

Interaction Between Fake IDs and Electronic Payments

Fraudulent Activities Using Fake IDs

Fake IDs can significantly impact electronic payment systems through various forms of fraud:

– Creation of Fake Accounts with a Kansas scannable ID: Fraudsters may use fake IDs to set up illegitimate accounts with financial institutions or payment platforms. These accounts can then be used to execute fraudulent transactions.

– Conducting Fraudulent Transactions: Individuals using fake IDs might perform unauthorized transactions, leveraging stolen identities to evade detection and commit financial crimes.The interplay between fake IDs and electronic payments highlights the legal age restrictions, such as those required for purchasing alcohol or tobacco. They are also used for various other deceptive purposes, such as accessing restricted services, enrolling in educational institutions fraudulently, or obtaining credit.

Social Impact of Fake IDs

The use of fake IDs presents several societal challenges:

– Challenges to Law Enforcement: Fake IDs complicate the enforcement of age-related laws and regulations. Law enforcement agencies face difficulties in distinguishing between genuine and fraudulent IDs, which undermines regulatory measures designed to prevent underage access to controlled substances.

– Social and Ethical Issues: The widespread use of fake IDs raises ethical concerns about honesty and integrity. It also reflects and potentially reinforces a culture of deceit, impacting societal norms and trust.

– Criminal Activities: Fake IDs can facilitate identity theft and other forms of fraud. Criminals may use these fake documents to create false identities, engage in illicit activities, or perpetrate financial crimes.

Relationship with Electronic Payments

Fake IDs are often linked to electronic payment systems in several ways:

– Creation of Fraudulent Accounts: Individuals using fake IDs may open fraudulent bank accounts or credit card accounts. These accounts can be used for various financial transactions, often involving illegal activities.

– Fraudulent Transactions: Missouri scannable ID can be used to execute fraudulent transactions on electronic payment platforms. For example, someone might use a fake identity to obtain a credit card and make unauthorized purchases.

Electronic Payments: Overview and Security

Overview of Electronic Payments

Electronic payments have become a fundamental aspect of modern financial transactions. They encompass various methods such as:

– Digital Wallets: Applications that store payment information and facilitate transactions via mobile devices.

– Mobile Payments: Payments made through smartphones using apps like Apple Pay, need for enhanced security measures and regulatory oversight to mitigate the risks associated with identity fraud and financial misconduct.Fake IDs enable individuals to bypass legal and regulatory barriers, while electronic payments provide a convenient platform for executing financial transactions. Together, they facilitate sophisticated fraud, such as creating fake accounts or conducting unauthorized transactions.

Economic Impact: The integration of fake IDs with electronic payment systems can lead to significant financial losses for businesses and institutions. Fraudulent activities result in direct monetary losses and increased costs for fraud prevention and detection.

In summary, the relationship between fake IDs and electronic payments highlights a critical issue in modern society. Addressing these challenges requires a multi-faceted approach, involving enhanced security protocols, stricter enforcement of regulations, and improved public awareness to mitigate the associated risks and safeguard both economic stability and social integrity

Home / Fake ID Shop / USA / michigan Fake ID